Daniele Bernardi, CEO of DIAMAN

For the wealth management industry, the pandemic and subsequent volatility provoked has shifted investor perceptions towards investment advice, with many now placing more importance on retaining a human-touch within advisory services.

Covid-19 sent the global markets into free fall as countries halted day-to-day activity, in order to halt the virus. Investors panicked – even those with the right advice lost money and those with less advice lost much more. According to DIAMAN’s survey of over 1000 investors in the UK, recent market uncertainty has left investors on automated advice platforms feeling unsupported. In fact, over half (54%) of respondents aged 18-25 said that, since the beginning of Covid-19 induced market volatility, they have lost trust in using robo advisors, with many (67%) investors now calling for a digital experience that also enables interaction with a human advisor, without the fees typically associated with bespoke services.

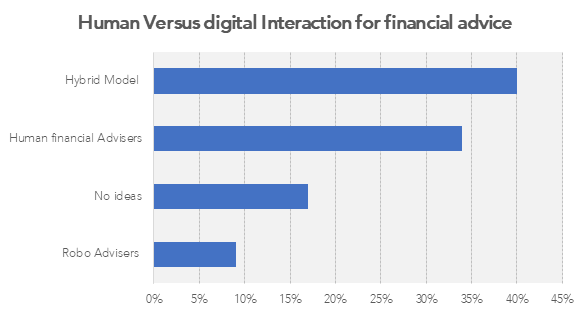

When asked about human versus digital interaction for financial advice, the most popular response was a hybrid model (40%), followed by a human financial adviser with no digital involvement (34%). And whilst 17% of investors did not have an opinion on this, just 9% want a robo adviser with no human involvement.

It might feel like the pandemic is the sole reason behind this shift in sentiment, but in reality, the industry has been heading towards this change for some time. This growing desire for a hybrid approach to investment advice may have been catalysed by Covid-19, but it can also be attributed to the rise, and fall of, robo-advice. Over the last decade, digital wealth managers have introduced a dose of long-needed disruption to the investment industry. Robo advisers stepped in to offer a new journey for inexperienced investors, digital enthusiasts, and seasoned investors with too small a pocket to justify the cost of going to an adviser. Just a few years ago, industry analysts gazed into their crystal balls and predicted that investors would pour their money into robo-advisors (in 2016, KPMG projected that AUM would be $2.2 trillion by now).

So why, in 2020, are we still waiting for the robo revolution?

Whilst robo-advice has come a long way over the last decade, it is far from entering the mainstream. Despite encouragement from the FCA and a strong belief that the digital natives would flock, the cost of aquiring new customers for robo advisers was simply too high and profit margins too low. And although many expected automated services to bridge the advice gap and get people saving and investing at a reasonable cost – the outcome was quite different. In reality, although digital tools have been used to drive down costs for investors, it has been at the cost of less human interaction, which in return has negatively impacted investor returns and risk exposure.

This begs the question: is coronavirus in fact the catalyst that the wealth management industry needed? Amongst many things, the pandemic has taught us that investors need access to an expert they can trust and to lean on to avoid behavioural investing mistakes – but without the price tag. Calls from the industry for a hybrid solution that combines expert advice with technology, to offer a personalised one-stop shop, have now been answered. Accelerated by Covid-19 induced market volatility, an economic, digital solution that retains human advice will likely become the new normal for investors and advisers alike.